-

Departments

-

- Departments Accounting Administration Aging and Disability Resource Center Arts & Culture Program Building Services Child Support Circuit Courts Clerk of Courts Coroner Corporation Counsel County Clerk Justice, Diversion, and Support

- Departments DNR Forester District Attorney's Office Emergency Management Environmental Health Extension Sauk County Health Care Center Health Highway Human Services Land Information/GIS Land Resources and Environment Management Information Systems

- Departments Parks and Recreation Personnel Register in Probate Register of Deeds Sheriff's Office Surveyor Treasurer Tri County Airport Veterans Service Victim Witness County Directory Social Media Links

-

-

Government

-

- County Board Board Members Meeting & Agendas Video Recordings Committees County Departments County Directory County Ordinances County Social Media Links Building Locations West Square Building Historic Court House Courthouse Annex Law Enforcement Center Health Care Center Highway Shop Human Services (Reedsburg) Parks and Recreation

- Calendar Meetings and Agendas Upcoming Meetings Meeting Videos on Granicus Video Recordings Forms and Documents Forms, Permits, and Applications Documents, Reports, and Presentations Policies Legal Notices/Press Releases Press Releases Legal Notices Foreclosure List Sheriff Incident Reports Open Records Request Sheriff's Dept Records General Records Request

- Voting / Elections MyVote - Polling Locations Register MyVote WI Election Results Bids and Proposals Submitting Bids / Bid Process Current RFPs, RFBs, RFQs State Government State Agencies Hours of Operation Hours

-

-

Community

-

-

Community News

Business / Economic Development Place Plan Start Up Resources Business Financing Chambers of Commerce Registration of Firm Name Creating an LLC Permits Revolving Loan Fund (RLF)/CDBG Persons with Disabilities Apply for Benefits Disability Rights Wisconsin Disability Benefit Specialists Housing Transportation Caregiver Resources Employment Training - Residents Voting Dog License Elected Officials Parks Recycling Renters Libraries Marriage School Districts Severe Weather Shelters Road Conditions DMV Services Sheriff's Incident Reports Online Services List of Online Services GIS Tax Parcel iSite Property Tax Info (ALRS) Pay Clerk of Court Fees

- Homeowner/Property Property Tax Information Property Maps Zoning Information Permits Recycling School Districts Residential Vacation Check Form Foreclosure List Family and Health Nurse-Family Partnership Immunization Program Women Infant Children Parks and Recreation Arts and Culture Libraries School Districts

- Seniors Retirement information Elderly Benefit Specialists Transportation Long Term Care Services Project Lifesaver Caregiver Resources Nutrition & Dining Centers Employment and Training Veterans Federal VA Services State Programs & Services Employment & Education Support Groups Health Care Home Loans Pension Benefits Transportation

-

Community News

-

-

Explore

-

-

ExploreSaukCounty.com

Parks Hemlock Park Lake Redstone Park Man Mound Park North End Boat Landing Sauk County Forest Summer Oaks Boat Landing Timme's Mill Weidman Woods White Mound Park Yellow Thunder Park -

Video Tour of Sauk County

Trails Great Sauk State Trail Hiking Horseback Skiing Snowmobiling Snowshoeing Outdoors & Nature Boat Landings Fishing Hunting Lakes, Rivers & Creeks Local Parks Natural Areas & Public Lands Nature Centers & Conservancies State Parks

Places to Eat & Drink Things to Do Places to Stay

-

ExploreSaukCounty.com

-

-

I Want To…

-

- Apply Marriage License Employment Passport Child Support Public Assistance Food Share Benefits BadgerCare Project Lifesaver Veteran's Benefits Dog License Permits Board of Adjustment Appeal/Zoning Appeal Arts & Culture Grants

- Request Obtain? Birth, Marriage, & Death Certificates Divorce Decree Court Transcripts White Mound Camping Reservation County Park Sticker Transportation Services Hunting Fishing Rec Permits Timber Cutting Permits Vehicle Registration Drinking Water Test Kits Soil Test Kits Pay Court Fees Traffic Tickets Property Taxes Child Support CPZ Fees

- File Divorce Will Deeds Property Liens Small Claims Guardianship Permits Claim for Service Related Disability (Veteran's) Appeal Zoning Ordinances Certified Survey Map Volunteer Aging & Disability UW Extension Parks Land Conservation Neighbor in Need

- Find Agendas and Minutes Property Tax Info Maps Foreclosures Sheriff's Incident Reports Warrant List Sex Offender Registry Zoning Info Voting/Election Info Sanitary/Septic Info Recycling Info Caregiver Relief/Assistance Genealogy Records Vote Register to Vote Polling Places

-

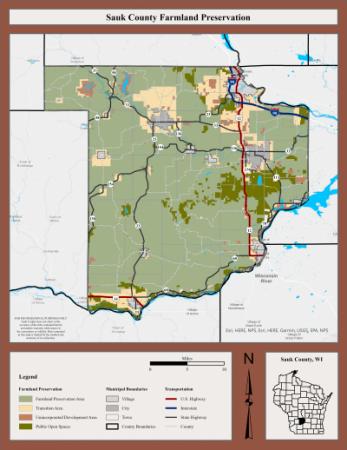

Farmland Preservation Program

What is the Farmland Preservation Program?

The Wisconsin Farmland Preservation Program (FPP) is designed to help local governments and landowners preserve agricultural land, minimize conflicting land uses, and promote soil and water conservation. Owners of farmland who participate in the program receive an income tax credit incentive.

Who is eligible to claim income tax credits through Farmland Preservation Program?

- Landowners must be residents of the state of Wisconsin.

- The farm must be in compliance with the soil and water conservation standards.

- The agricultural use of the land must produce at least $6,000 in gross farm revenue the previous year or $18,000 over the previous three years.

Landowners within Bear Creek and Fairfield Townships can apply for a farmland preservation agreement for land owned and located within an Agricultural Enterprise Area (AEA). A farmland preservation agreement requires the land to be kept in agricultural use for 15 years and to meet state soil and water conservation standards. In return, the agreement enables the landowner to claim a farmland preservation tax credit.

Farmland Preservation Plan Update

Over the past year, Sauk County has been working to update of the Sauk County Farmland Preservation Plan which outlines strategies and policies which designate how the County participates in the Farmland Preservation Program. The Wisconsin Farmland Preservation Program (FPP) is designed to help local governments and landowners preserve agricultural land, minimize conflicting land uses, and promote soil and water conservation. A draft of the plan is available for review by using the link below are by visiting the project website using the link below.

Please contact Brian Simmert at 608-355-4834 or email brian.simmert@saukcountywi.gov with any questions on the plan.